Online banking fraud victims in Milton Keynes' region lost nearly £7 million in 2020-21

and live on Freeview channel 276

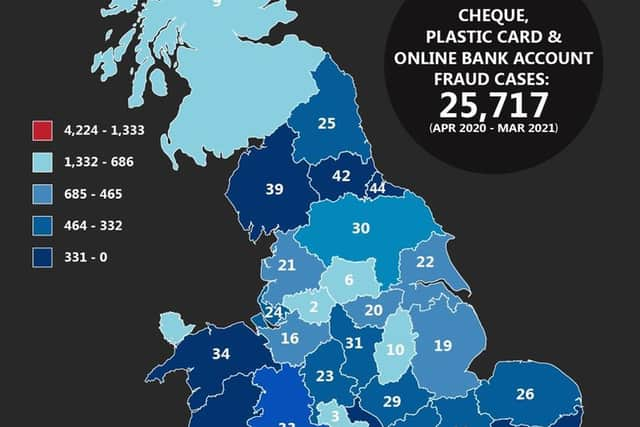

Thames Valley Police reported 971 cases of cheque, plastic card and online bank account fraud from April 2020 to March 2021.

Across the UK the figures skyrocket to a staggering £161,221,800 lost to victims of this kind of online scam. Figures show, 25,717 different people in the UK fell victim to this crime in just a 12-month period.

Advertisement

Advertisement

Data from the National Fraud Intelligence Bureau has been analysed by MoneyTransfers.com to identify which areas suffer the most from plastic card fraud.

The most cases of this kind of fraud came in July 2020, whilst November was next worse, 2,349 and 2,341 cases were reported in those months respectively.

Analysis from MoneyTransfers.com, showed that the average financial loss per case came out at £6,269.

Milton Keynes' police force came fourth overall when it came to total number of cases reported. The Thames Valley trailed, the Metropolitan Police, and also Greater Manchester and West Midlands forces.

Advertisement

Advertisement

In the Thames Valley there were 971 cases in comparison to 4,224 reports made to the Met Police, 1,332 in Greater Manchester and 1,265 in West Midlands. The worst month for cases in the Thames Valley was June 2020 when 106 incidents were reported. The lowest amount of cases per month, was in February when there were 60 cases.

A spokesperson for MoneyTransers.com offered four pieces of advice to avoid these incidents happening to you:

1) Stay Vigilant

-Even though it may feel taxing, it is a good idea to keep a close eye on your monthly bank statement(s) to make sure there is no unusual activity and if there is, report it immediately to your respective bank(s).

2) Avoid Public Wi-Fi Hotspots

-Do not use public Wi-Fi hotspots such as those in coffee shops and libraries to access online banking or carry out financial transactions as you cannot be certain how your personal information is being tracked and logged by their respective networks.

3) Take Online Banking Precautions

Advertisement

Advertisement

Only access online banking via your bank providers official website and not by means such as clicking on a link provided in an email. Likewise, when it comes to mobile banking, only use your bank providers official app and keep the app updated for the latest and strongest security protection.

4) Have Strong Credentials

Make the password for your online banking as sophisticated as possible – this includes using a combination of numbers, special characters, uppercase and lowercase letters. When it comes to the pin for your bank card, don’t make it very obvious such as the current year (e.g. 2021) or a combination of credentials from your date of birth (e.g. dd/mm, mm/yr etc).